will capital gains tax rate change in 2021

For example if you had 900000 in wages and 200000 in long-term capital. Chancellor Rishi Sunak is reportedly considering changing capital gains tax rates in todays Budget.

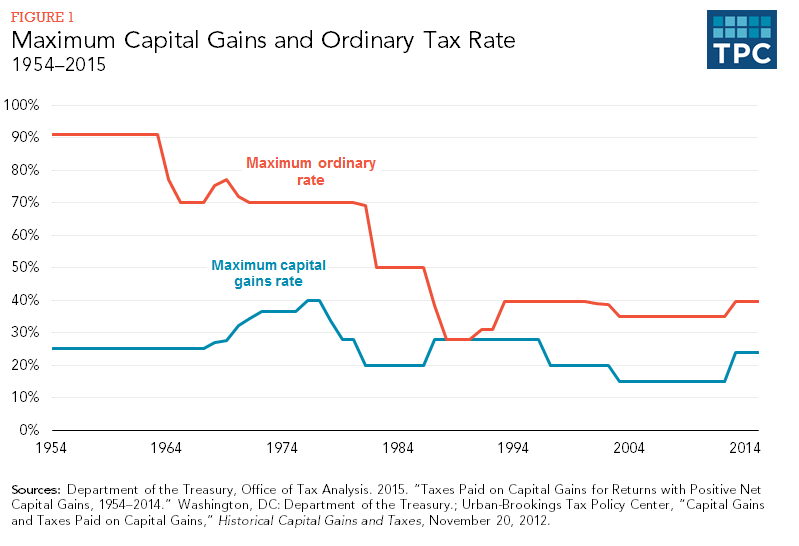

Capital Gains Full Report Tax Policy Center

On April 28 2021 Joe Biden proposed to nearly double the.

. However it was struck down in March 2022. 2021 US Capital Gains Tax Changes - Alpen Partners AG 1 week ago The current capital gain tax rate for wealthy investors is 20. There are rumours he may try to bring rates more in line with income tax.

Reuters Will capital gains tax increase. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more. On April 28 2021 Joe Biden proposed to nearly double the.

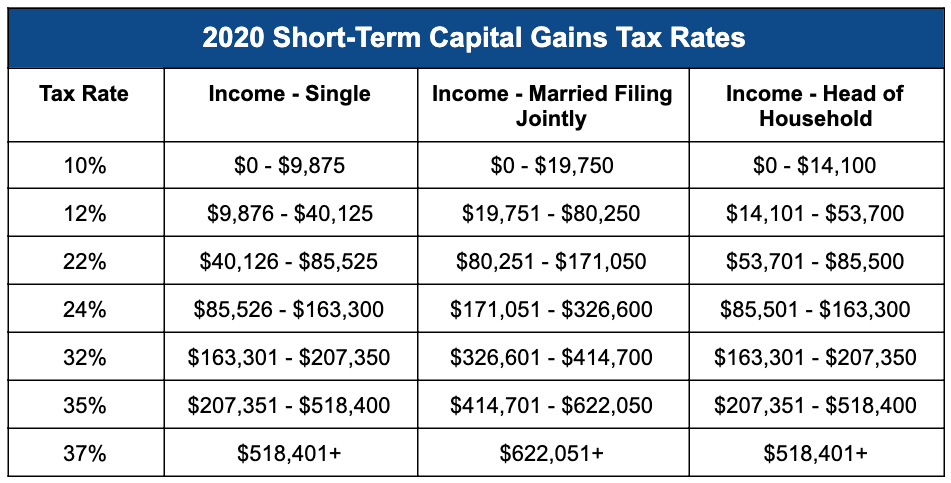

Or sold a home this past year you might be wondering how to avoid tax on capital gains. 2021 US Capital Gains Tax Changes - Alpen Partners AG 1 week ago The current capital gain tax rate for wealthy investors is 20. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed.

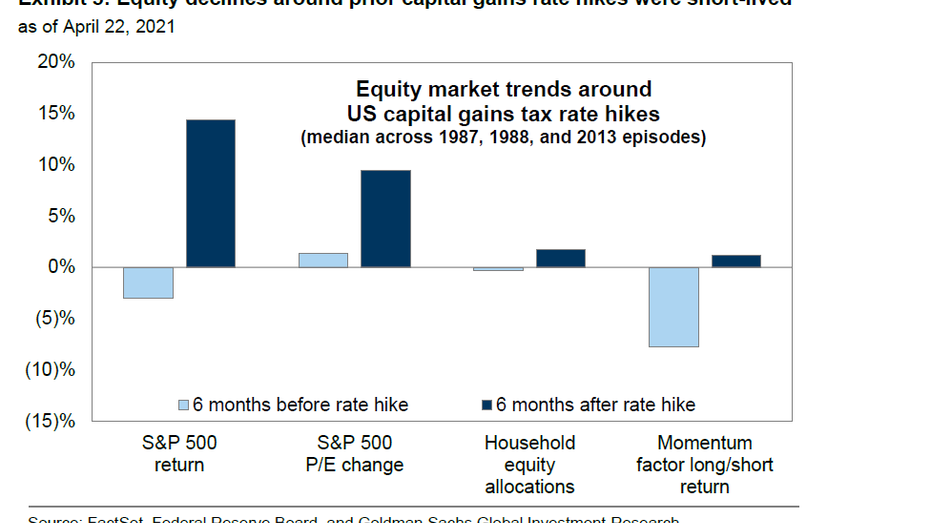

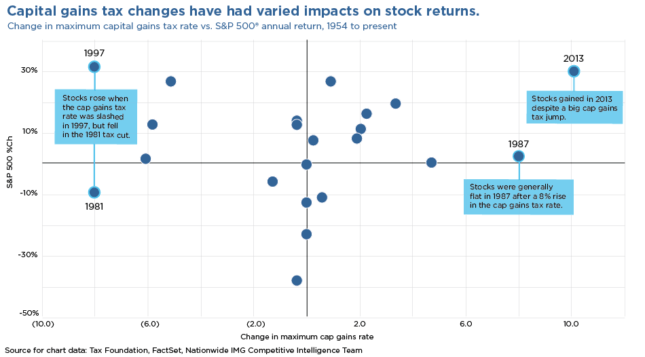

History is a good indicator of the impact of a capital gains increase on. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. The effective date for this increase would be September 13 2021.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Perhaps had Congress looked to enact such. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

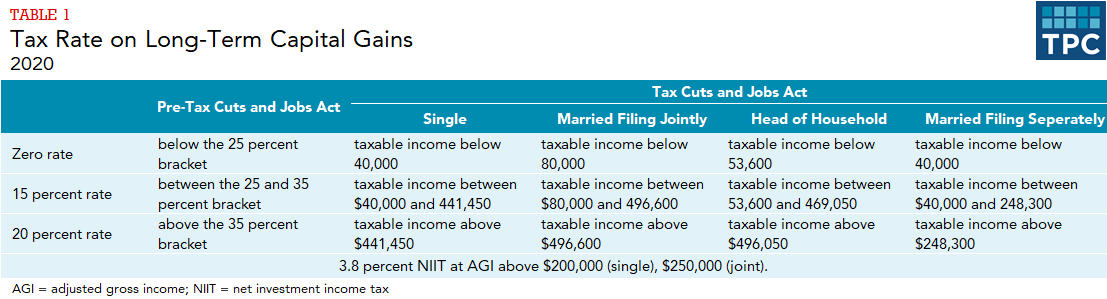

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Capital Gains Tax Rate 2021. What the property tax is and why rate could change in the 2021.

The 238 rate may go to 434 an 82 increase. He would also change the tax rules for unrealized. Add state taxes and you may be well over 50.

As proposed the rate hike is already in effect for sales after April 28 2021. Short-term gains are taxed as ordinary income. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some.

This means youll pay 30 in Capital Gains. 4 rows In addition to this tax rate increase the Biden Administration is calling to raise the marginal. Capital Gains Tax UK changes are coming.

Rishi Sunak is reportedly considering reforming capital gains tax Photo. For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. Note that short-term capital gains taxes are even.

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. The chart below illustrates how the change in capital gains tax rates affects the sellers net proceeds. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

They are generally lower than short-term capital gains tax rates. Biden plans to increase this. I was able to get all 2021 transactions from 3.

Bidens plan would raise the top tax rate on capital gains to 434 from 238 for households with income over 1 million. The Long And Short Of Capitals Gains Tax When you include the 38 net investment income tax NIIT and some state income taxes you could be looking at a 48 all-in capital gains. Long-term capital gains assets held for more than one year are a little more complicated and are based on the taxpayers taxable income AGI and filing status.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Capital Gains Tax What Is It When Do You Pay It

How Are Capital Gains Taxed Tax Policy Center

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

Capital Gains Tax In The United States Wikipedia

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Capital Gains Tax In The United States Wikipedia

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What You Need To Know About Capital Gains Tax

Real Estate Capital Gains Tax Rates In 2021 2022